The magicians -The Pigasus experiment - Fall.

Does the Neo- Keynsean theories and principles,regarding the western capitalistic economies,are not working enymore,?

Keynsean theories are used and applied in ex- free market economies,and the role of Central Banks.was limited,connected to the plans of a govermend,to which C.Banks,WITH THEIR FISCAL - MONETARY policies,used to provide the required assistance and financial instruments, to politicians,to accomplish their public financial objective targets..

Now days there is no capitalistic system.There is only the so called cannibalistic mafia banksters corporative system,or neo- bolsevicism-leftist-globalist system,which is based only in fraud -robbery-deception-manipulation-greed.

There are no principles on this system,because there is no morality-values-ideals invested on this totally corrupted-dissintegrated system.

The financial system in western economies,as has been evolved the last decates,had one goal,by design.To create businnes-individuals,investors-consumers =Debt Slaves!!

The decision makers therefore,either politicians or central bankers,are not to be considered as stupids,

because they are not!!They are more than well paid, plus any additional gifts and presents (sometimes millions),for favors and services provided to their masters.The most possible,and quite obvious to the experts,they are part of the game,working hard to accomplish and fulfill their criminal master,s plans. Certainly not all of them.

There is no Logical reasonic on the decisions taken either by the EEU or ECB leaders-politicians or Technocrats-buraucrats,in respect of the national -ultranational debt issue.

The AUSTERITY policies applied by the leading EEU countries ( Germany ),or The EEU High Commision,and afterwards imposed to *sick* countries,didn,t resolved or provided any assistance,for solving the problems.On the contrary they almost totally destroyed the countries,which supposevely the EEU offered their assistance and solitarity.

Millions of people lost their jobs,and huntred of thoudands of houshold units and families,left without income.Most of the small-medium enterprises closed their activities or shut down,because are left without capital to run their businnes.More people left without jobs and income,and this resulted to lower demand -spending -consumption ,and for more businnes shut down (- accelarator).

This is not Policy.It is more likely cocoos-nest lunatic behaviour..By intention and design!!

How Mario Draghi and the ECB expects to create motives and the sphycological envirement for small or big investors, to create new jobs and new opportunities,if both the consumers and the investors are allready drown in debts-left also without income coming in.

Most of the famous economists and experts,they suggest that the play of the Central Bankers with the interest rates-especially the negative interest rates-is in no way to have possitive outcome for the economies.The most possible, is going to blow up in their faces,resulting to Bank runs by the depositors,who see now, that their money,instead of getting increased,are getting less with the negative interest rates applied by the banks!!

The most possible, as the experts are suggesting,we are going to see, not only bank runs and bank,s bankruptcies,but the collapse of the whole financial system,and the beginning of the EEU disintegrasion.It is a warning and a potential outcome.

We hope and pray,that this is not going to happen.

For the time being well done to all decision makers in EEU,who with their visions(!!!) contributed to this great accomplishmend and the fullfilmend of their masatermind master,s plan .!!!

Burning Wings!

............................................

The Author

.................................................................................................................................................

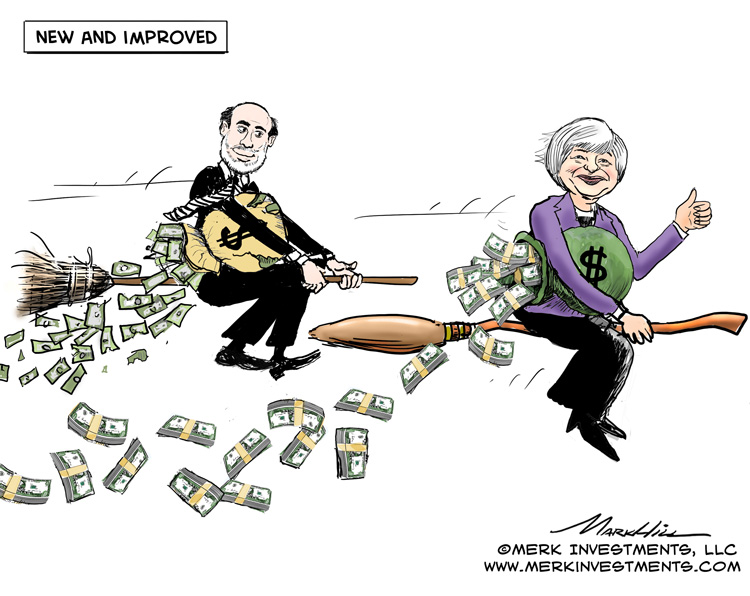

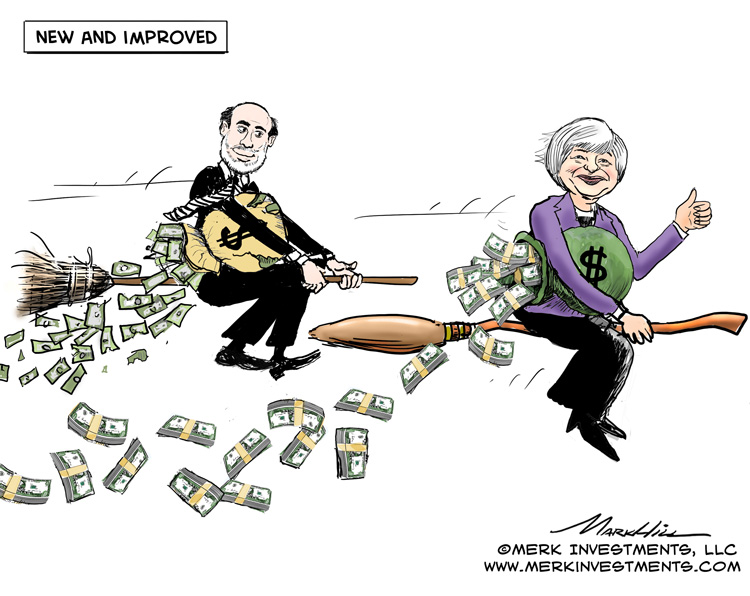

* 1 Picture : 1000 words !!!!

The third magician is missing on flight!Where is Mario ?

.............................................................................................

Stockman's Corner

...........................................................................................................

Yes, the man is totally deranged, and so is the entire eurozone policy apparatus. Like much of officialdom elsewhere in the world, the ECB is attempting to fight low growth and low inflation with monetary nitroglycerin. Its only a matter of time before they blow the whole financial works sky high.

Low real GDP growth in the eurozone has absolutely nothing to do with the difference between –0.3% on the ECB deposit rate versus the new -0.4% dictate announced this morning; nor does QE bond purchases of EUR 80 billion per month compared to the prior EUR 60 billion rate have anything to do with it, either. The only purpose of such heavy handed financial intrusion is to make borrowing cheaper for households and businesses.

But here’s what the moronic Mario doesn’t get. The European private sector don’t want no more stinkin’ debt; they are up to their eyeballs in it already, and have been for the better part of a decade.

The growth problem in Europe is due to too much socialist welfare and too much statist taxation and regulation, not too little private borrowing. These are issues for fiscal policy and elected politicians, not central bank apparatchiks.

As shown in the chart below, the eurozone private sector had its final borrowing binge during the initial decade of the single currency regime through 2008; debts outstanding grew at the unsustainable rate of 7.5% annually. But since then the eurozone private sector has self-evidently been stranded on the shoals of Peak Debt.

Outstandings have flat-lined for the past eight years—-not withstanding increasingly heavy doses of ECB interest rate repression that have finally taken money market rates into the netherworld of subzero.

Nor has the approximate EUR $700 billion of bond purchases since QE’s inception last March made one wit of difference. Bank loans outstanding to the private sector were EUR 10.24 trillion at the end of January or exactly where they stood in March 2015 when Draghi and his merry band of money printers went all in.

By the same token, it is damn obvious that low inflation is not a problem, and that, in any event, it is not caused by lack of money printing and insufficient interest rate repression by the goofballs assembled at the ECB’s swell new headquarters in Frankfurt. The eurozone’s respite from its normal 1-2% annual dose of headline inflation is entirely imported via the global tide of plunging oil, commodities, steel and other industrial prices.

That welcome tide of imported deflation, in turn, is actually improving the eurozone’s terms of trade and raising consumer living standards; and it is not remotely connected to anything the ECB has done or not done in the last year or even four years.

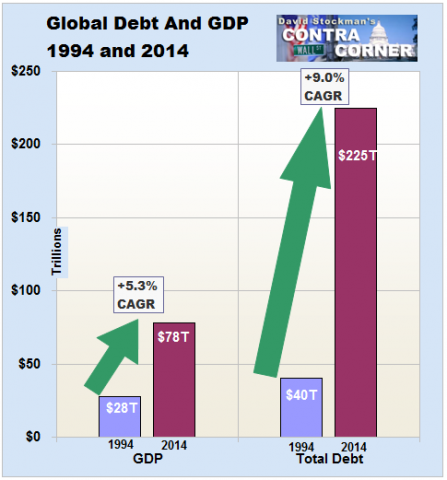

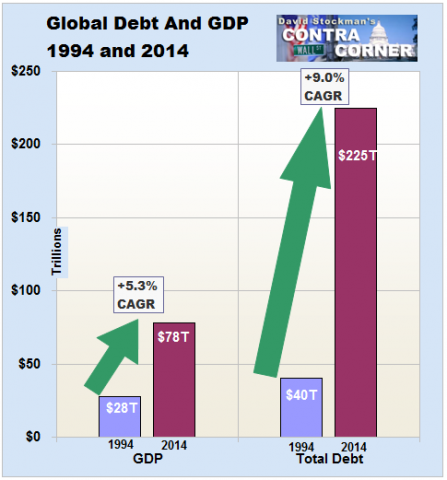

Instead, the global deflation is a consequence of the massive malinvestment in mining, energy, industry, transportation and distribution which has resulted from the 20-year global credit binge enabled by the world’s convoy of money printing central banks. Incremental debt of $185 trillion or nearly 4X GDP growth during that period has crushed the world’s capacity for investment and production led growth.

The overhang of excess capacity everywhere on the planet is also drastically compressing prices, margins and profits, but the major impact is in the Red Ponzi and its EM supply chain; and the secondary impact is on engineered machinery, high tech and luxury goods exporters, including Germany and other eurozone export strongholds.

It goes without saying, however, that today’s .....

Read more..

http://davidstockmanscontracorner.com/draghis-deadly-derangement/

*Phodos added

Does the Neo- Keynsean theories and principles,regarding the western capitalistic economies,are not working enymore,?

Keynsean theories are used and applied in ex- free market economies,and the role of Central Banks.was limited,connected to the plans of a govermend,to which C.Banks,WITH THEIR FISCAL - MONETARY policies,used to provide the required assistance and financial instruments, to politicians,to accomplish their public financial objective targets..

Now days there is no capitalistic system.There is only the so called cannibalistic mafia banksters corporative system,or neo- bolsevicism-leftist-globalist system,which is based only in fraud -robbery-deception-manipulation-greed.

There are no principles on this system,because there is no morality-values-ideals invested on this totally corrupted-dissintegrated system.

The financial system in western economies,as has been evolved the last decates,had one goal,by design.To create businnes-individuals,investors-consumers =Debt Slaves!!

The decision makers therefore,either politicians or central bankers,are not to be considered as stupids,

because they are not!!They are more than well paid, plus any additional gifts and presents (sometimes millions),for favors and services provided to their masters.The most possible,and quite obvious to the experts,they are part of the game,working hard to accomplish and fulfill their criminal master,s plans. Certainly not all of them.

There is no Logical reasonic on the decisions taken either by the EEU or ECB leaders-politicians or Technocrats-buraucrats,in respect of the national -ultranational debt issue.

The AUSTERITY policies applied by the leading EEU countries ( Germany ),or The EEU High Commision,and afterwards imposed to *sick* countries,didn,t resolved or provided any assistance,for solving the problems.On the contrary they almost totally destroyed the countries,which supposevely the EEU offered their assistance and solitarity.

Millions of people lost their jobs,and huntred of thoudands of houshold units and families,left without income.Most of the small-medium enterprises closed their activities or shut down,because are left without capital to run their businnes.More people left without jobs and income,and this resulted to lower demand -spending -consumption ,and for more businnes shut down (- accelarator).

This is not Policy.It is more likely cocoos-nest lunatic behaviour..By intention and design!!

How Mario Draghi and the ECB expects to create motives and the sphycological envirement for small or big investors, to create new jobs and new opportunities,if both the consumers and the investors are allready drown in debts-left also without income coming in.

Most of the famous economists and experts,they suggest that the play of the Central Bankers with the interest rates-especially the negative interest rates-is in no way to have possitive outcome for the economies.The most possible, is going to blow up in their faces,resulting to Bank runs by the depositors,who see now, that their money,instead of getting increased,are getting less with the negative interest rates applied by the banks!!

The most possible, as the experts are suggesting,we are going to see, not only bank runs and bank,s bankruptcies,but the collapse of the whole financial system,and the beginning of the EEU disintegrasion.It is a warning and a potential outcome.

We hope and pray,that this is not going to happen.

For the time being well done to all decision makers in EEU,who with their visions(!!!) contributed to this great accomplishmend and the fullfilmend of their masatermind master,s plan .!!!

Burning Wings!

............................................

The Author

.................................................................................................................................................

* 1 Picture : 1000 words !!!!

The third magician is missing on flight!Where is Mario ?

.............................................................................................

Stockman's Corner

Draghi’s Deadly Derangement

by David Stockman •

........................................................................................................................

* Deranged Personality : Definition

The individuals whom ttheir personality is been exposed

for long-long time to fraudulent intentions.

...........................................................................................................

Draghi’s Deadly Derangement

Yes, the man is totally deranged, and so is the entire eurozone policy apparatus. Like much of officialdom elsewhere in the world, the ECB is attempting to fight low growth and low inflation with monetary nitroglycerin. Its only a matter of time before they blow the whole financial works sky high.

Low real GDP growth in the eurozone has absolutely nothing to do with the difference between –0.3% on the ECB deposit rate versus the new -0.4% dictate announced this morning; nor does QE bond purchases of EUR 80 billion per month compared to the prior EUR 60 billion rate have anything to do with it, either. The only purpose of such heavy handed financial intrusion is to make borrowing cheaper for households and businesses.

But here’s what the moronic Mario doesn’t get. The European private sector don’t want no more stinkin’ debt; they are up to their eyeballs in it already, and have been for the better part of a decade.

The growth problem in Europe is due to too much socialist welfare and too much statist taxation and regulation, not too little private borrowing. These are issues for fiscal policy and elected politicians, not central bank apparatchiks.

As shown in the chart below, the eurozone private sector had its final borrowing binge during the initial decade of the single currency regime through 2008; debts outstanding grew at the unsustainable rate of 7.5% annually. But since then the eurozone private sector has self-evidently been stranded on the shoals of Peak Debt.

Outstandings have flat-lined for the past eight years—-not withstanding increasingly heavy doses of ECB interest rate repression that have finally taken money market rates into the netherworld of subzero.

Nor has the approximate EUR $700 billion of bond purchases since QE’s inception last March made one wit of difference. Bank loans outstanding to the private sector were EUR 10.24 trillion at the end of January or exactly where they stood in March 2015 when Draghi and his merry band of money printers went all in.

By the same token, it is damn obvious that low inflation is not a problem, and that, in any event, it is not caused by lack of money printing and insufficient interest rate repression by the goofballs assembled at the ECB’s swell new headquarters in Frankfurt. The eurozone’s respite from its normal 1-2% annual dose of headline inflation is entirely imported via the global tide of plunging oil, commodities, steel and other industrial prices.

That welcome tide of imported deflation, in turn, is actually improving the eurozone’s terms of trade and raising consumer living standards; and it is not remotely connected to anything the ECB has done or not done in the last year or even four years.

Instead, the global deflation is a consequence of the massive malinvestment in mining, energy, industry, transportation and distribution which has resulted from the 20-year global credit binge enabled by the world’s convoy of money printing central banks. Incremental debt of $185 trillion or nearly 4X GDP growth during that period has crushed the world’s capacity for investment and production led growth.

The overhang of excess capacity everywhere on the planet is also drastically compressing prices, margins and profits, but the major impact is in the Red Ponzi and its EM supply chain; and the secondary impact is on engineered machinery, high tech and luxury goods exporters, including Germany and other eurozone export strongholds.

It goes without saying, however, that today’s .....

Read more..

http://davidstockmanscontracorner.com/draghis-deadly-derangement/

*Phodos added